Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED

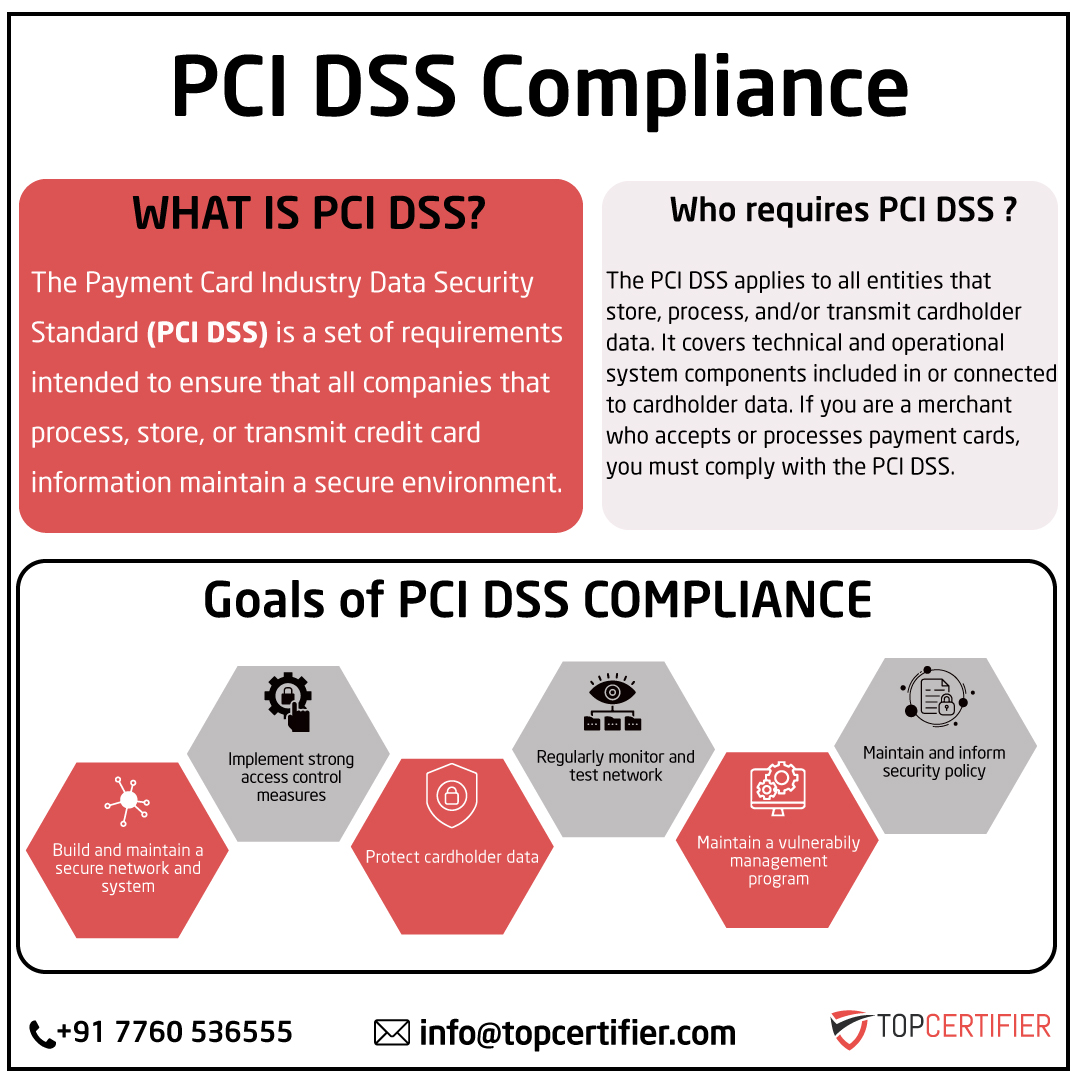

PCI DSS certification refers to compliance with the Payment Card Industry Data Security Standard, which helps organizations protect cardholder data, secure payment systems, and prevent unauthorized access to sensitive payment information.

PCI DSS certification in Egypt is important because it helps businesses secure card transactions, reduce payment fraud, protect customer data, and maintain trust with banks, payment providers, and customers.

PCI DSS certification is required for merchants, e-commerce businesses, payment gateways, banks, fintech companies, retailers, and service providers that process, store, or transmit cardholder data.

The main benefits of PCI DSS certification include enhanced payment data security, reduced risk of card fraud, improved customer confidence, and stronger control over payment processing systems.

PCI DSS certification is required by payment card brands and acquiring banks for organizations that accept card payments, making it essential for secure payment operations.

PCI DSS protects cardholder data by requiring secure networks, strong access controls, encryption, monitoring, and information security policies across the payment environment.

Yes, PCI DSS certification is applicable to businesses of all sizes. Small and medium-sized businesses can implement PCI DSS requirements based on their payment processes and data handling scope.

Industries such as retail, e-commerce, fintech, banking, hospitality, travel, subscription services, and online marketplaces benefit most from PCI DSS certification.

Organizations can work with experienced PCI DSS consultants in Egypt who provide support for gap analysis, security implementation, documentation, and compliance validation.

Organizations can start PCI DSS certification by reviewing payment data flows, identifying security gaps, implementing required controls, and working with qualified consultants to achieve compliance.